Hello, dear readers! In this article I will raise such an important topic as personal finance management in the modern world. Most likely, you have already heard and read a lot about this, so I will not focus on the details.

First, we will briefly examine the importance of managing personal finances, then I will give a couple of recommendations that I have tested to improve my financial condition, and finally I will talk about the Cash Organizer application, which has been guarding my finances for several years. It was thanks to him that I began to master financial literacy and got rid of debt.

Why is it important to manage personal finances, and what are the consequences of their improper distribution?

It is no coincidence that I added the phrase “in the modern world” when talking about personal finance management. In the modern world, advertising is everywhere, and marketers go to even greater lengths to get you to buy their product (even if you don’t really need it). Add to this the economic crisis, and we get very unpleasant, but official statistics.

According to gazeta.ru, as of the first quarter of 2016, more than half of the economically active population of Russia (40 million people) had debt to banks or microfinance organizations. At the same time, only 8 million people, that is, only 20%, can “serve” their debts.

And, most likely, the situation will not change much in 2017. It is quite possible that even the 20% who were able to service their debts are still paying interest. So what should you do if you find yourself in this statistic or want to spend your money more efficiently so that you always have enough money? Let's try to figure this out.

- Set aside money for a rainy day. If it doesn’t work out, imagine that tomorrow you will lose your job, what will you do then?

- Try not to borrow money, especially when it comes to loans and microloans.

- Think twice before buying this or that item.

- Be legally savvy. If you are being harassed by debt collectors, check out the laws regarding debt collectors. If you are not paid at work, read the labor code. Believe me, you have a lot more rights than you think.

- Plan your budget, write down expenses and income, look for where you can save. Personally, I use the Cash Organizer application for this, which will be discussed further.

Cash Organizer

Let's start with the fact that Cash Organizer is not only an application for mobile devices, but also a full-fledged program for personal computers, which already sets this project apart from its competitors. The PC version offers more structured and accurate reporting, while the version for mobile devices pleases with its portability and synchronization with banks.

Naturally, these two versions can work together, allowing you to take advantage of their benefits simultaneously. You can check out the PC version on the developer’s website, and I’ll tell you about the version for mobile devices, since I use it most often.

As soon as we downloaded and opened the application, we get here:

If you used the Web version or the PC version, then using the menu you can easily access the already created database. If you have not used Cash Organizer before, then it is best to follow the link and read the instructions.

As for me, one of the most important advantages of Cash Organizer is the instructions. Unlike most similar services, the instructions do not contain a “dry” description of the functionality, but a detailed explanation, which focuses on the capabilities for each user.

We will now briefly examine what these capabilities are, using the example of the 5 most interesting, in my opinion, functions, as well as a short list of the main competitive advantages of Cash Organizer.

Budget

This is a set limit for any category of expenses. For example, you allocated 20,000 rubles for entertainment this month. If it is more, you will not have enough money for other important expenses.

To prevent this from happening, you can sit with a notebook and count all your expenses, or you can use Cash Organizer, set a budget for the “entertainment” category and be able to track the limit for this category in real time.

Reporting

As I said earlier, Cash Organizer is not only a convenient application, but also a full-fledged program for the PC. If you suddenly want not only accuracy, but also structure, here is a comparison of reporting in two versions.

Plan (scheduled payments)

If you own a car, you probably know how important it is to remember to renew your insurance. Personally, scheduled payments help me not so much to predict a possible shortage of funds (and such a function is provided), but to simply help me not to forget about an important payment.

As soon as the payment day approaches, the application immediately sends a notification to the phone menu, reminding you of scheduled payments. If there are many such payments and they are constant, you can also set the payment frequency in Cash Organizer.

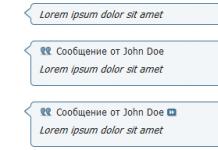

Joint account

One of the unique features of Cash Organizer is the ability to maintain a joint account with another user, for example, with your husband. If you have a case where your husband earns money, and you spend the family budget, then this function will help you track all expenses in real time, as well as jointly plan payments.

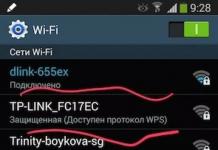

Synchronization with banks

Another convenient feature is the ability to synchronize the application with the bank. If you use your card often, you won’t have to constantly enter payments manually, and categories will be selected automatically.

Additional functions

- Supports any iOS, Android, Windows and Mac devices.

- Ability to create categories, subcategories, projects and subprojects of unlimited nesting.

- Password protection, 256-bit encryption, and a security system that prevents even the developers themselves from accessing your data.

- Unlimited number of bank accounts to connect.

- Calculation and information about the grace period for credit cards.

- The ability to divide a payment into several components, placing them in different categories.

Among the disadvantages of this application, I can only emphasize its great functionality, which at first may seem not entirely clear and even unnecessary. That’s why I recommended reading the instructions first, with them you will be able to work freely in the application in ten minutes, and you will also understand which functions you really need and which ones are better to discard.

Where can I download the application?

- Link to Cash Organizer developer website: cashorganizer.com

- App store:

- Google play: https://cashorganizer.onelink.me

Let's sum it up

Returning to the topic of managing personal finances in the modern world, we can say with confidence that, in addition to a bunch of ways to spend money, many tools have also appeared for saving it. Cash Organizer is direct proof of this.

Using this powerful and modern saving tool along with the recommendations described above, I have really made my life easier and become more effective in managing my money. To make sure of this, you don’t need to believe me, just try to implement these recommendations into your life - and the result will not take long to arrive. I wish you success!

Finance is one of the few things that a person can completely (and to a large extent) control. And for them to love you, you must also love them and pay attention to them. At a minimum, keep records of them, know the flow of traffic and plan for them and your future.

How can you keep track of your finances? Now there are a huge number of ways to do this: programs on the phone and on the computer, paper versions, tables in Excel. You can choose any one. I tried many: several computer programs, a program on my phone, an Excel spreadsheet, and a paper version. Over many years of keeping home financial records, I realized that the most convenient way for me is the synthesis of a paper diary and an Excel spreadsheet. In a notebook, I write down all current expenses and can easily answer the question “when did we fill up the car and what was the price of gas,” “how much did a trip to the dentist cost a couple of months ago,” or “how much did we spend on food in October?” I make pivot tables on the computer, where you can see the dynamics by month.

At home, I keep financial records in a regular student notebook: on one side I write down current expenses weekly, on the other side of the notebook I write down financial planning by month.

And when I saw the “Financial Diary”, of course, I could not pass it up. Because this is an opportunity to try something new in the already familiar paper accounting.

Before you start accounting for your finances, it’s a good idea to write down your financial dreams and the date they will come true.

It also clearly explains with examples how to keep a table of monthly income

and expense table

And an example of recording expenses for the day

Overall, I really liked the diary, but I have some wishes.

What I liked:

-introduction with financial management tips. Here is a summary of the very basics, the most necessary

-table " My dreams" - after all, if there are no financial goals, accounting loses all meaning

-tables for each month" 10 next steps to increase my income" - every month you need to sit down and think about what else you can do to get closer to your financial dream

-tables for each month" 10 ways to cut your expenses" - think about what exactly I can save on this month

-financial wellness pages for every month

every month, by writing down the numbers, you will see how you are moving towards your dream, towards your result

I liked that the author makes you think and do conclusions every day And sum up the month

-I liked it at the very end of the diary" Journal of victories and financial achievements" - a very important thing for motivation and in moments when you give up

-excellent quality of publication, nice paper, convenient bookmark- this is as always from the publishing house MYTH

-I really liked that every week has its own theme And every day there is advice from the author of a journal for reflection.

What I didn't like:

- the call in the introduction to pamper yourself every day. In my opinion, this is fundamentally contrary to achieving financial goals. Sometimes, occasionally - of course, but not every day. Again the echo of “You deserve it” is heard.

- I didn’t like that all the planning for the month is at the end of the month. Those. First there are 4 weeks of accounting, and then only all the tables that I showed a little higher. It seems to me that it is more logical to first plan the month, imagine what your finances are, then keep records and at the end draw conclusions. The same with 10 ways to save and increase income: in order to implement them within a month, you must first plan them, think about them and then implement them.

-that the diary is only for 3 months. The publication is not cheap - that's it. And two - I would like to see at least a year's worth of records collected in one volume. Otherwise, it turns out that 4 such books will be collected in a year, and they need to be stored somewhere else.

I am sure that if you have never kept financial records, such a diary is an easy and enjoyable way to start doing so.

And if you are already advanced in the field of home finance, such a diary is a great opportunity to try something new and adopt it for yourself.

As usual, on the MIF publishing house website

A financial organizer is a way to manage your household finances. Of course, there are quite a wide variety of computer programs on the Internet that allow you to manage your home budget. But I’m probably old-fashioned and prefer to do it on paper. I am not a professional, not an accountant or an economist. Therefore, my system may not be completely perfect. But with the onset of each year, by printing out old ones or creating new templates, I try to improve it little by little.

I keep all bills and documents related to financial matters in a ring binder. Now there are quite a lot of different folders, but even the number of colors that exist in stores is not enough for me.

Therefore, to begin with, I simply repainted the folder using acrylic enamel.

Until the paint has dried, it seems that the folder is structural and striped. But after the acrylic enamel dries, the folder looks as if it was its original color. If you want to keep the transparent inserts at the end, simply seal them with paper tape. I don't need them, because... I'll put a label on top.

I didn't tape the rings inside, but simply took a small brush and very carefully traced the entire surface around the metal part.

Once you've painted one side, don't forget to wipe off any paint stains on the back side before they dry, then you'll be pleased with the results.

I want to make 5 planning folders in total. In addition to the financial organizer, home organizer, and Christmas planner, I will have folders dedicated to my hobbies and planning home projects, a folder dedicated to my child and my family.

I glued stickers to both the end part and the front part. Perhaps this is not necessary, because... folders I'm going to recolor all 5 to separate them by color.

There will also be sections inside the financial organizer, which I separated with A4 separators printed on a color printer.

Invoices that have not yet been paid are located at the very beginning of the folder in front of the Invoice Payment Control Sheet (more on that a little later).

I also store all paid bills for the current year in a financial organizer (and then put them in the archive). To store them directly in a folder, I use these transparent envelopes with a clasp or button. I also mark them so as not to get confused about where the bills are for the apartment, and where for electricity, etc.

To quickly find the desired section in the folder, in addition to the A4 dividers (they are simply inserted into transparent files), I will glue additional side dividers.

These separators greatly simplify the search for the desired subsection:

then simply cut along the outline, fold in half and glue on the side to a transparent file so that it can be seen.

I also glued dividers onto the clear folders with paid bills. Perhaps this was already unnecessary, since there are not so many of these daddies. But since I had enough dividers to fit on an A4 sheet to print, I decided to print for these folders at the same time.

Immediately after the transparent folder intended for short-term storage of unpaid bills, I have a Bill Payment Tracking Sheet. Once I receive the invoice, I place it in a clear folder at the front of the binder, once it is paid, I make a note on the Bill Payment Tracking Sheet, and then I place the invoice and receipt in the appropriate folder at the end of the organizer.

Additionally, you can use the payment calendar in the form of a traditional calendar for the year (if you prefer, mark in it with circles or a marker the days when payments need to be made). Similar to the accounting calendar for paying taxes.

Next in my financial organizer are the worksheets related to budgeting:

We have planned the budget, now let's move on to monitoring its actual implementation.

To control monthly cash receipts and expenses for each day during the month, you can use these Sheets for tracking monthly expenses and income.

Debts. Unfortunately this is part of our life. We give and take money in debt, on credit, etc. Therefore, in order to control these cash flows, do not forget who owes you and how much or to whom you owe and when you need to repay this debt, you can use templates for monitoring receivables and payables for the year and tracking debt payments (yours and yours).

Cash Organizer is a small but powerful online service for joint management of finances and their subsequent visualization both in the browser and using applications on PC, Mac or Android.

The functionality of the service may well be sufficient even for financial accounting in small companies. Cash Organizer does not limit users in any way: you can enter countless accounts, create an unlimited number of templates, and connect other people to a single interface and account management. This helps both in family and at work.

The service includes sections for accounts, payments, budget and plan. It should be noted that when purchasing a license, the user receives the following functions:

- Cloud storage and the option to synchronize any number of devices.

- Cash Organizer desktop application for Windows and MacOS X.

- Mobile version for Android smartphones and tablets.

- Full access to the service when there is no Internet connection.

- Simultaneous work with the database from different devices.

- Online access to the service using a range of web browsers and extensions.

- Full support for joint accounts.

- Adding categories with different nesting.

- Adding projects with different nesting levels.

- Supports 126 currencies.

- Journal of changes in exchange rates.

- Transfers and splits.

- Budget management.

- Plans for upcoming payments.

- Reconciliation of the invoice with the bank statement.

- Generating various reports.

- Data backup and recovery.

- Import QIF.

- And other.

Personal financial organizer with a funny name "Ahh Hah!" — a full-fledged set of functions for setting financial goals and accompanying support on the way to their implementation.

It may seem strange when someone is trying to plan out the next 10 to 20 years of their own life financially. However, the personal financial organizer "Ahh Hah!" was created just for such conscious people. A specially designed set of financial tools aims to help the user by greatly simplifying this difficult task of spending planning.

The kit is a series of tools that help organize, file and divide everything into special sections. Over time, you will be able to easily find the desired section with the necessary information, spending just a few seconds on it. In the modern world, it’s hard to believe that most people don’t plan their finances at all and waste money thoughtlessly. It is better to take this more seriously, which will significantly improve the quality of life in the future.

The original financial organizer places all records in one place to allow users to clearly identify where to find certain information. This approach eliminates the need for users to spend endless amounts of time searching for files on the computer, and also prevents the loss of important financial records. Now the consumer has a real opportunity to take all financial matters into his own hands. Personal Financial Organizer "Ahh Hah!" - an excellent invention from a talented team of economists and designers.

If you want to work on your financial literacy and put things in order, pay attention to the Finparty portal, which is entirely dedicated to the lives of financiers, businessmen and investors. You will be able to learn how successful people work with money, maintaining and increasing finances in different areas of business.